Homeowners Insurance in and around Topeka

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Your home and property have monetary value. Your home is more than just a roof and four walls. It’s all the memories made in your family room and around the kitchen table. Doing what you can to keep your home protected just makes sense! That's why one of the most sensible steps is to get excellent homeowners insurance from State Farm.

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

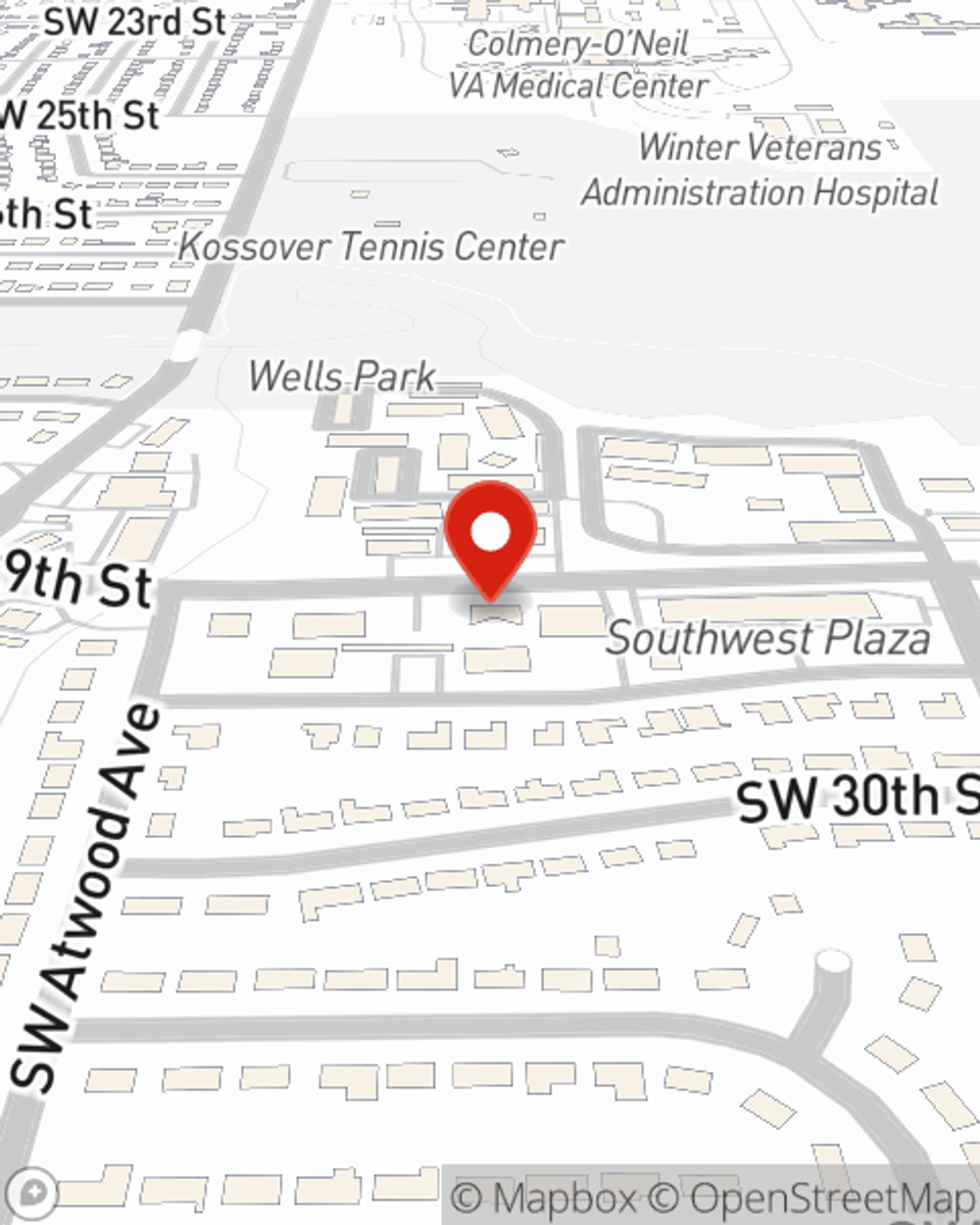

State Farm's homeowners insurance safeguards your home and your valuables. Agent Ryan Mohwinkle is here to help build a policy with your specific needs in mind.

Excellent homeowners insurance is not hard to come by at State Farm. Before the unexpected happens, reach out to agent Ryan Mohwinkle's office to help you put together the right home policy for you.

Have More Questions About Homeowners Insurance?

Call Ryan at (785) 273-1572 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Ryan Mohwinkle

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.